Vermont Yankee nuclear plant closure in 2014 will challenge New England energy markets

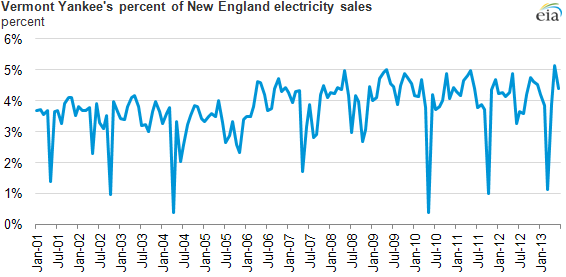

The pending closure of a 41-year-old nuclear plant located in Vermont will likely affect both natural gas and electricity markets throughout New England. Entergy Corporation's August 27 announcement of the closure of the Vermont Yankee plant cited economic challenges to continued operations at the 604-megawatt (MW) plant, which since 2007 has generated about 4% of New England's total annual electricity supply. The shutdown is expected in fourth-quarter 2014, when the plant's current fuel cycle ends.

Note: Monthly statistics on net generation from Vermont Yankee are divided by total retail sales for New England

Entergy's announcement cited a number of financial factors for the retirement, including:

- Low wholesale electricity prices, driven in part by lower natural gas prices, which have reduced the profitability of the plant

- Significant capital costs for maintaining the unit, which began operations in 1972

- Low prices in the regional market for electric generating capacity, which provides revenue to plant owners in addition to their revenues from electricity sales

Natural gas basis futures contracts

Natural gas basis futures contracts are financial instruments that reflect the difference between the futures price of natural gas at the benchmark Henry Hub in Louisiana and the forward price of natural gas at another delivery point somewhere else in the country. Large values often indicate transportation congestion on pipelines between producing regions and consuming regions. Transactions involving these monthly contracts can take place over periods spanning a few months to years. Recent changes in the location of natural gas production have also produced negative basis values in and around the Marcellus production region.

Entergy operated Vermont Yankee as an independent power producer (also called a merchant generator), meaning that the costs associated with running or maintaining the plant cannot be recovered through regulated cost-of-service rates.

The retirement of any baseload unit will create challenges for grid operators in a region, but the coordination between natural gas and electricity markets in New England has been a key topic in recent years.

Natural Gas

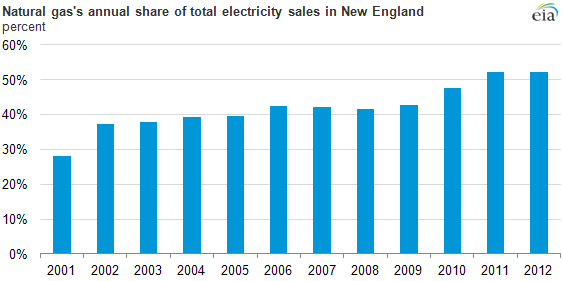

New England has significantly increased its reliance on natural gas as a fuel for electric generation in the past few years. Natural gas fueled less than 30% of the electricity generated in New England in 2001, but that figure rose to 52% in 2012 (see chart below). Increased gas use for power generation has contributed to pipeline transportation constraints in the New England regional natural gas market. These pipeline constraints are more pronounced in winter months, when natural gas is used to heat homes and businesses as well as to produce electricity. These supply constraints contributed to extreme price spikes in spot natural gas and electricity prices in New England during January and February 2013.

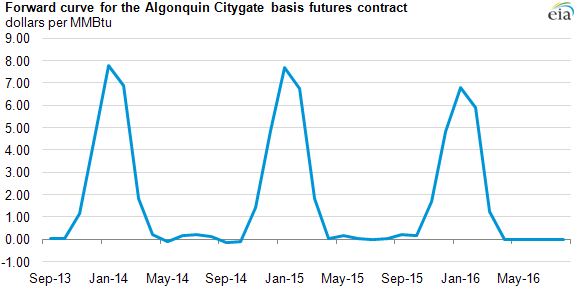

In New England, a key delivery point is the Algonquin Citygate, a natural gas trading hub in Boston. The price differential, or basis, between Henry Hub and Algonquin is usually less than $1/million British thermal units (MMBtu) in the spring, summer, and fall. Because of increasing pipeline constraints in New England, these differences have been growing, and they are most pronounced in the winter. For individual days in the winter, the basis in New England can be multiples of the spot price of natural gas at Henry Hub, and the average difference in the natural gas price between Henry Hub and Boston can average more than $6/MMBtu every day in a peak demand month like January. The August 27, 2013, forward curve below shows that the Algonquin Citygate basis futures contracts rising to nearly $8/MMBtu in the winters of 2013-14 and 2014-15.

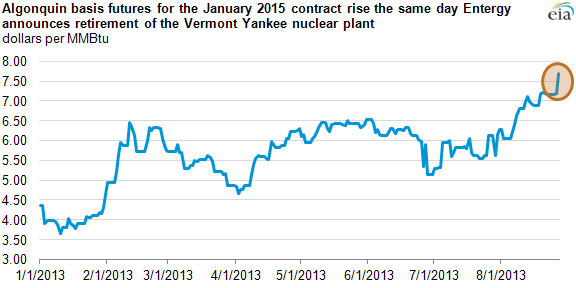

The same day Entergy announced the retirement of the Vermont Yankee nuclear power plant, the Algonquin Citygate forward basis swap for the January 2015 contract month—the month following the announced retirement date—rose about 50 cents per MMBtu.

In 2012, natural gas was the marginal fuel—the fuel price that sets the price for operating generators—in New England about 81% of all operating hours, according to the Independent System Operator of New England. With that trading pattern, rising wholesale natural gas prices would tend to increase wholesale power prices in New England.

Electricity

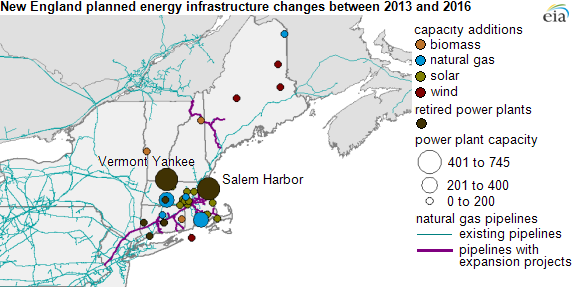

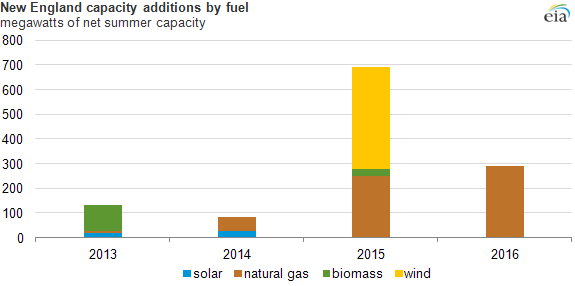

Including the Vermont Yankee nuclear plant, New England expects to see more than 1,369 MW of generation retired between 2013 and 2016. Dominion Energy Resources is planning to retire the nearly 750-MW Salem Harbor coal- and petroleum-fired power plant in Massachusetts in 2014. Dominion cited a combination of the costs of compliance with new environmental regulations as well as declining profits for coal-fired units in Independent System Operator of New England.

On the other hand, 1,193 MW of capacity is expected to come on line in New England between 2013 and 2016. Half of the capacity additions will be from natural gas, with another 34% coming from new wind turbines.

New England imports significant amounts of electricity from Hydro-Quebec in Canada, an inflow that can be increased to offset the loss of regional capacity. Several Vermont electric utilities signed a 26-year contract with Hydro-Quebec Energy Services, which took effect in November 2012, to supply electricity to the state. Upgrades to the transmission system may be needed to facilitate these increased imports.

Tags: electricity, futures, generating capacity, map, natural gas, New England, nuclear, retirements, states