India’s coal industry in flux as government sets ambitious coal production targets

Note: India fiscal year is April to March. For example, FY2005 represents April 1, 2004, to March 31, 2005. Data for 2015 are preliminary.

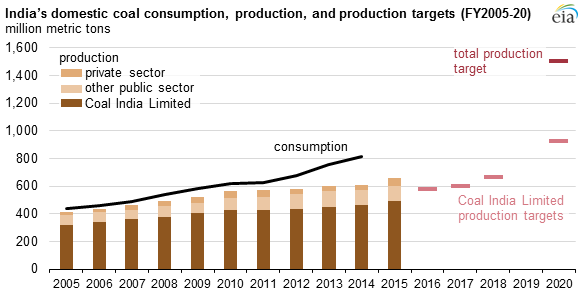

Coal consumption in India, particularly in the electric power sector, is outpacing India's domestic production. From 2005 to 2012, India's coal production grew by only 4.7% per year to about 600 million metric tons while the country's coal-fired electric power capacity grew by a much faster rate (about 9.4% per year), reaching 150 gigawatts. To help resolve the shortfall in coal supply and to support expanded coal-fired generation, India has set a coal production target of 1.5 billion metric tons by 2020. Recent shifts in government policies and practices may play a key role in India's ability to meet this coal production goal.

Increasing coal production from its national coal producer. Coal India Limited (CIL), the national coal producer responsible for more than 80% of India's current production, initially planned to produce 1 billion metric tons of coal by FY2020, almost double its FY2015 production. Although CIL revised its current expectations downward to about 900 million metric tons, its annual production must still rise faster than the current rate of increase to achieve its new goal. Since 2012, CIL has increased coal production by outsourcing production operations to private and foreign companies in an effort to improve mechanization and mining expertise and by working to adhere to detailed mine plans for achieving its 2020 production target.

Encouraging greater private and foreign participation. In August 2014, allegations of impropriety, hoarding of coal resources, lost government revenue, and a lack of transparency led India's Supreme Court to cancel 214 coal licenses allocated to the private and public sector, representing 9% of FY2013's production. The Ministry of Coal quickly reauctioned many of these properties to help minimize the disruption from the cancellation, but the impact of this redistribution of coal properties on production is uncertain.

Private mining may be expanded further as a result of the Coal Mines Special Provision Bill passed in March. This law opens the door to commercial coal mining by both private companies and foreign companies having an Indian subsidiary. The government is now evaluating the effect of a coal block auction to allocate properties for commercial development—a significant change for a coal industry that has been nationalized for 40 years.

Easing environmental restrictions, permitting processes, and land acquisition. Forest clearances, environmental permits, and land acquisition challenges remain obstacles to the rapid development of India's coal industry. In 2012, the government dropped a forestry policy that had blocked 660 million tons of potential coal production, and drafts of its replacement suggest a forest policy that may be more lenient toward mining. The Ministry of Coal is tracking mine projects in the preproduction stage to monitor the speed of permit processing and environmental clearances, and it may intervene if there are significant delays. If passed, the Land Acquisition Reform Act pending in India's Parliament could make it easier to acquire land for coal mining activity, potentially displacing farmers and landowners in coal-producing regions.

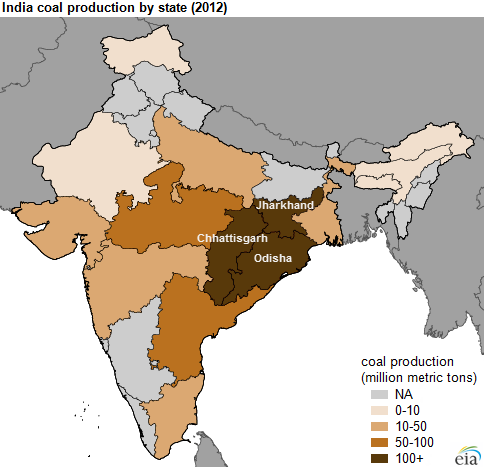

Focusing attention on coal transportation expansion. In 2014, 50 million tons of coal were stranded at mines because of rail limitations, including line congestion and a shortage of railcars. Several coal-rail projects have stalled over the past decade, including the 93-kilometer Tori-Shivpur-Kathautia line to connect coal mines in Jharkhand in eastern India. Begun in 1999 and scheduled to be completed in 2005, this project is still only halfway done. Lately, the government is concentrating on three key rail projects that together could facilitate an additional 100 million metric tons of coal production. The earliest of these is the Jharsuguda-Barpali railway link scheduled to be completed in 2017 in Odisha, a key coal-producing state directly south of Jharkhand.

Principal contributor: Diane Kearney

Tags: coal, consumption/demand, electricity, generation, India, international, map