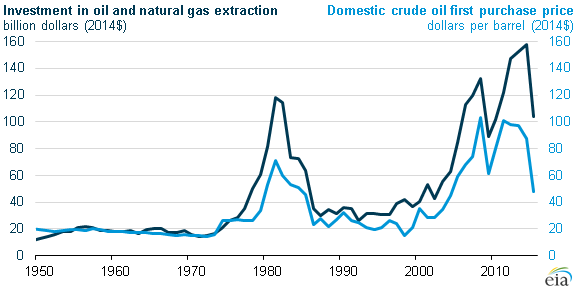

Sustained low oil prices could reduce exploration and production investment

Note: 2015 data are the average of the first two quarters.

Low oil prices, if sustained, could mark the beginning of a long-term drop in upstream oil and natural gas investment. Oil prices reflect supply and demand balances, with increasing prices often suggesting a need for greater supply. Greater supply, in turn, typically requires increased investment in exploration and production (E&P) activities. Lower prices reduce investment activity.

Overlaying annual averages of the domestic first purchase price (adjusted for inflation) on oil and natural gas investment reveals that upstream investment is highly sensitive to changes in oil prices. Given the fall in oil prices that began in mid-2014 and the relationship between oil prices and upstream investment, it is possible that investment levels over the next several years will be significantly lower than the previous 10-year annual average.

Oil production is a capital-intensive industry that requires management of existing production assets and evaluation of prospective projects often requiring years of upfront investment spending on exploration, appraisal, and development before reserves are developed and produced.

Previous investment cycles provide insights into how investment responds to crude oil price changes. In 1981 and 1982, after crude oil prices significantly increased, investment topped out at more than $100 billion (in 2014 dollars) and then averaged $30 billion to $40 billion per year into the early 2000s as crude oil prices fell and remained in the $20-$30 per barrel (b) range. From 2003 to 2014, investment spending increased from $56 billion to a high of $158 billion as crude oil prices increased from $34.53/b to $87.39/b, including several months of prices reaching more than $100/b. EIA's 2015 Annual Energy Outlook Reference case projects real domestic first purchase prices to average about $70/b in 2020. This price level could result in substantially lower annual oil and natural gas investment over the 2015-20 period than the annual average of $122 billion spent during the 2005-14 investment cycle crest period.

Principal contributors: Grant Nülle, Jeffrey Barron

Tags: liquid fuels, oil/petroleum, prices