Petroleum product exports from Central Atlantic states were unusually high in February

Note: PADD is Petroleum Administration for Defense District. Finished petroleum products include asphalt and road oil, distillate, jet fuel, kerosene, lubricants, petroleum coke, residual fuel, special naphthas, and total motor gasoline.

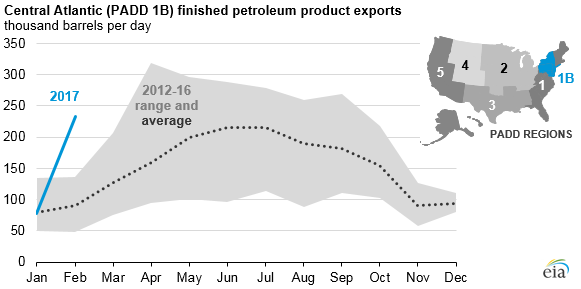

Exports of finished petroleum products from the Central Atlantic region of the United States (Petroleum Administration of Defense District, or PADD 1B) reached a record high in February 2017. Increased exports were driven by lower prices for several petroleum products in the Central Atlantic region compared with prices in other regions in the Atlantic Basin. Distillate fuel and total motor gasoline, the two most-consumed petroleum products globally, were among the products that showed an increase in exports.

Distillate exports from Central Atlantic states totaled more than 103,000 barrels per day (b/d) in February, a record high for the month. Distillate fuel is usually imported into the Northeast during the winter months because 22% of households in the Northeast use distillate fuel for home heating, a higher proportion than in any other U.S. region. However, because temperatures were warmer than normal in February 2017, domestic demand was relatively low.

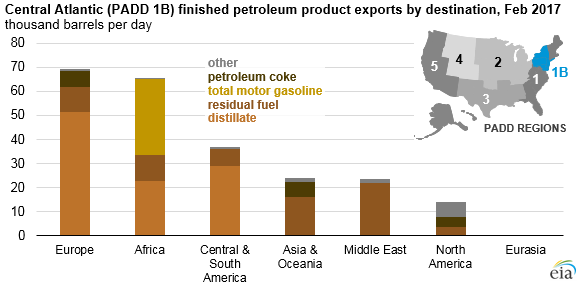

Europe received 50% of the total distillate exported from Central Atlantic states in February 2017. The remainder went to Central and South America (28%) and Africa (22%). Total motor gasoline exports from Central Atlantic states totaled more than 31,000 b/d in February, much more than the 1,000 b/d average of the previous five Februarys. Nearly all of the gasoline exports from Central Atlantic states went to countries in Africa.

The atypical volume of petroleum product exports from Central Atlantic states in February 2017 occurred because the region’s prices of these petroleum products were more competitive than normal compared with product prices in other regions in the Atlantic Basin. Lower relative prices in the Central Atlantic made exports to countries in Africa, Central and South America, and Europe more attractive.

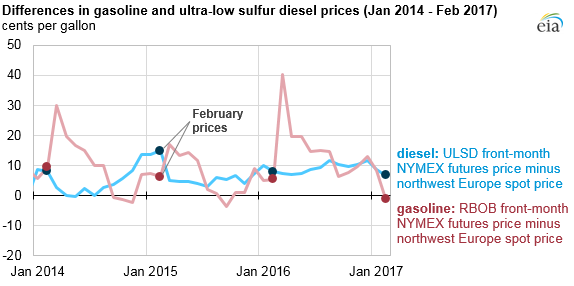

In the beginning of 2017, gasoline and ultra-low sulfur diesel (ULSD) futures prices in New York Harbor weakened against gasoline and ULSD spot prices in Northwest Europe, a major trading hub in the Atlantic Basin market. Comparing futures prices with spot prices helps to account for transit times associated with shipping products across oceans.

The Northwest Europe gasoline spot price exceeded the reformulated blendstock for oxygenate blending (RBOB) front-month futures price on the New York Mercantile Exchange (NYMEX) in February (Figure 3), the first such premium for that month since at least 2010. The price spread between the NYMEX ULSD front-month futures price and the Northwest Europe ULSD spot price declined to the lowest level for the month of February since the underlying commodity of the NYMEX ULSD futures contract switched to a distillate with lower sulfur specifications in May 2013.

Note: ULSD is ultra-low sulfur diesel. RBOB is reformulated blendstock for oxygenate blending and represents the petroleum component of gasoline used in many parts of the United States. NYMEX is the New York Mercantile Exchange.

The gasoline price premium in Northwest Europe in February likely reflected differences between inventory growth in Europe and in the United States during the first two months of the year. Gasoline inventories at the trading hub of Amsterdam-Rotterdam-Antwerp (ARA) in northwest Europe were lower than the previous year because of higher exports from Europe to Africa and other regions. In contrast, total gasoline stocks reached a record high on February 10, 2017, in the New England and Central Atlantic states (PADDs 1A and 1B, respectively). The decline in U.S. gasoline consumption in January and February kept gasoline inventories high.

Distillate stocks in the ARA region have been lower than last year’s level for several months. In New England and Central Atlantic states, however, distillate stocks were higher than last year’s level in February, likely because of decreased demand associated with warmer temperatures.

In Europe, colder-than-normal temperatures, higher distillate exports from the region, and an accelerated expansion of the manufacturing sector in the Eurozone area may have contributed to lower distillate inventories than last year and to higher northwest Europe ULSD spot prices compared with NYMEX ULSD front-month futures prices than in recent years.

Principal contributor: Rebecca George