Ethane production growth led to record U.S. natural gas plant liquids production in 2017

Republished June 21, 2018, to correct the 2018-2019 NGPL production growth.

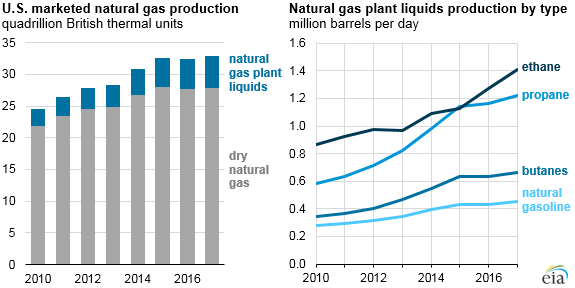

U.S. natural gas plant liquids (NGPL) production has nearly doubled since 2010, outpacing the rate of natural gas production growth and setting an annual record of 3.7 million barrels per day (b/d) in 2017. NGPLs are produced at natural gas processing plants, which separate liquids from raw natural gas to produce pipeline-quality dry natural gas. Marketed natural gas includes both NGPLs and dry natural gas.

Growth in U.S. natural gas production has been driven by shale gas, particularly from the Appalachian region, and to a lesser extent by associated natural gas, a byproduct of crude oil production. The high liquids content of many shale plays means that growth in marketed natural gas production has led to increased production of NGPLs.

NGPLs accounted for a growing share of marketed natural gas production between 2010 and 2017, making up 15% of total marketed production in 2017 in energy content terms, up from 11% in 2010. The increased share of NGPL production can be attributed to expanded capacity to produce, transport, and consume NGPL products. Increases in NGPL production pushed two measures of total natural gas production—gross withdrawals and marketed production—to record highs in 2017.

NGPLs that come out of natural gas plants are a mix of ethane, propane, isobutane and normal butane, and natural gasoline that requires further processing to convert into separate marketable products. The yield of these liquid products, especially ethane, varies significantly depending on product prices, the ability to process and distribute them to market, and the makeup of the raw natural gas.

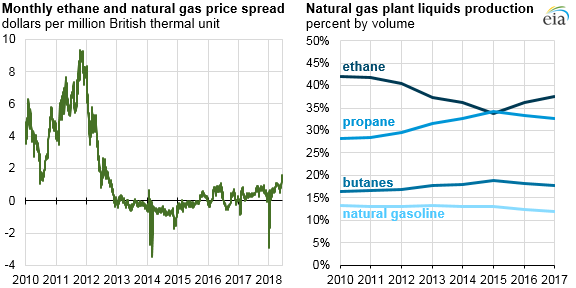

With the exception of ethane, natural gas plant operators may leave only trace amounts of NGPLs in dry—pipeline-quality—natural gas. Natural gas specifications set by pipeline operators allow for significant amounts of ethane to be left in dry gas at the discretion of natural gas plant operators. If ethane prices are low relative to the price of natural gas on a heating-value equivalent basis, more ethane is likely to be left in the dry natural gas stream, provided that the mix can still meet specifications required by natural gas pipeline operators.

U.S. ethane prices began declining relative to natural gas prices in late 2011 and remained consistently lower than the price of natural gas between 2013 and 2015 when ethane production began to outpace consumption. As a result, the ethane share of total U.S. NGPLs declined between 2012 and 2015, when natural gas producers had the incentive to leave as much ethane in pipeline natural gas as possible to capture its value as a heating fuel instead of recovering and selling it as a separate product.

U.S. ethane prices began to increase in 2016 when ethane demand increased, and ethane prices surpassed natural gas prices in the United States on a heat-content equivalent basis in 2016 and 2017, causing the ethane share of U.S. NGPL production to increase as well.

Two U.S. ethane export terminals opened in 2016, and two U.S. ethane-consuming petrochemical plants opened in 2017, providing additional sources of demand. Annual average U.S. NGPL production increased nearly 400,000 b/d between 2015 and 2017, and about 175,000 b/d of this increase resulted from growth in ethane production.

Several more petrochemical plants are expected to come online in the United States in 2018 and 2019, further driving increases in ethane demand and prices. First-quarter 2018 U.S. ethane production was 260,000 b/d higher than the first-quarter 2017 level. Ethane production will increase by another 440,000 b/d between the first quarter of 2018 and the fourth quarter of 2019, according to EIA’s Short-Term Energy Outlook, accounting for 52% of the growth in NGPL production.

Principal contributor: Stacy MacIntyre