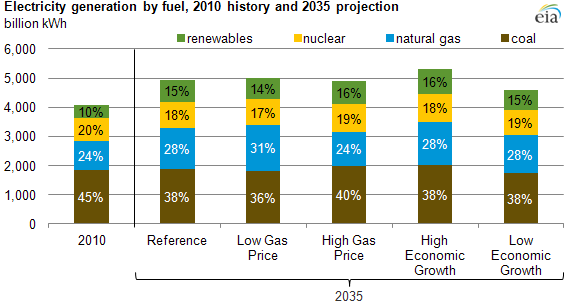

Fuel used in electricity generation is projected to shift over the next 25 years

While coal is projected to retain the largest share of the electricity generation mix through 2035, analyses included in the Annual Energy Outlook 2012 (AEO2012) anticipate its share declining as more generation comes from natural gas and renewable technologies. Coal's role as the preeminent source of electricity generation in the United States has lessened in recent years, declining from 49% of total electricity generation in 2007 to 42% in 2011.

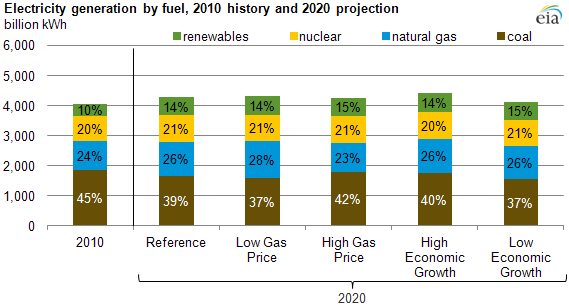

The shifts are due to changes in the comparative costs of electricity generation that result from changes in natural gas prices, coal prices, economic growth, and the implementation of the Cross-State Air Pollution Rule and the Mercury and Air Toxics Standards. The Annual Energy Outlook includes alternative scenarios where the different assumptions about future fuel prices and economic growth illustrate the sensitivity of the electric power markets to these factors. For comparison with the projected values for 2035 in the chart above, the chart below presents projected electricity generation by fuel in 2020.

Projected fuel prices and economic growth are key factors influencing the future electricity generation mix. The price of natural gas, coal's chief competitor, has dropped significantly in recent years due to the increase in domestic production of natural gas. The sensitivity of the electric power market to changes in natural gas prices is illustrated in the high and low gas price alternative cases. The high gas price case results in less generation from natural gas relative to the Reference case. This results in coal, nuclear, and renewables retaining a larger share of the generation mix. Conversely, lower gas prices result in more generation from natural gas, whose share grows relative to those of the other sources. Fuel prices affect overall generation by influencing how existing plants are dispatched and in some cases whether or not they are retired. They also play a key role in the investment decisions for potential new plants.

AEO2012 also features cases that assume high and low economic growth relative to the Reference case. In the high economic growth case, coal generation increases relative to the Reference case as coal plants that might otherwise have retired remain operational to keep up with growth in the demand. On the other hand, weak economic conditions lead to lower electric demand, which reduces the need for generation.

In all cases highlighted, most of the growth in renewable electricity generation comes from wind and biomass facilities, which benefit from State Renewable Portfolio Standard (RPS) requirements, Federal tax credits, and, in the case of biomass, the availability of low-cost feedstocks and the Renewable Fuel Standard (RFS). Overall, the amount of generation from nuclear power in 2035 increases from 2010 levels in all cases with the highest growth in the high gas price and high economic growth case. Despite the growth, nuclear's share of total generation in generation in 2035 is projected to fall below its 2010 level in all of the cases.

Every AEO2012 cases assume that all coal plants must have either a Flue Gas Desulfurization (FGD) system or Direct Sorbent Injection system installed by 2015 in order to continue operation in compliance with environmental rules. Currently, over half of the coal plants in the nation have FGD systems. Details relating to projected coal plant retirements in the AEO2012 analysis will be highlighted in an upcoming article.

A full description of this analysis can be found in the Annual Energy Outlook's Issues in Focus section.