2012 Brief: Natural gas liquids prices down in 2012

Note: Natural gasoline contains pentanes and hexanes, the primary components of pentanes plus.

This article continues a series of briefs on energy market trends in 2012.

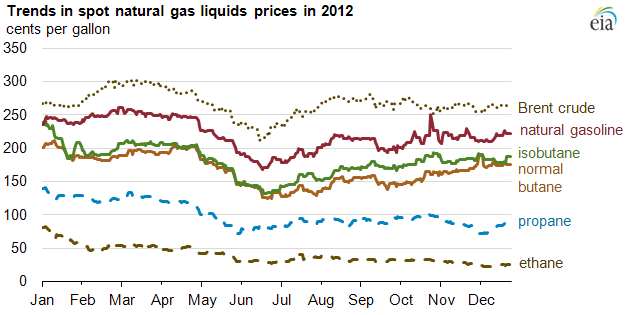

Daily spot prices for natural gas liquids (NGL)—ethane, propane, normal butane, isobutane, and natural gasoline—were generally down in 2012. Ethane and propane, the lower-priced NGL, shown as dashed lines in the chart, experienced the largest percentage declines relative to 2011 average prices. Prices for natural gasoline, isobutane, and normal butane, shown as solid lines, more closely track oil prices, shown as a dotted line.

Note: Natural gasoline is the product name used by the spot and futures markets to describe pentanes and hexanes. These are the primary components of pentanes plus, the term used by EIA in its surveys and reports.

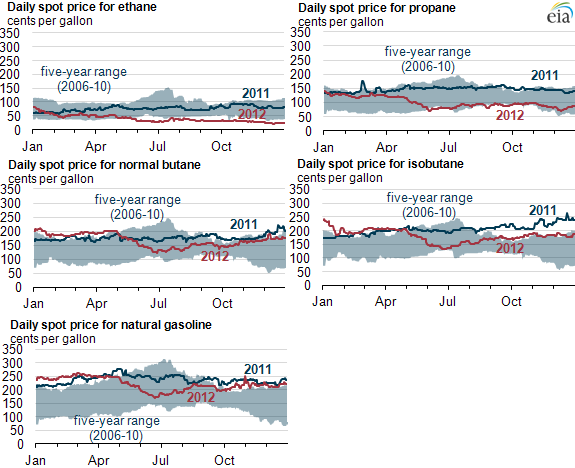

Spot prices for ethane and propane were near or below the bottom of the 2006-10 range in the second half of 2012. Propane's average 2012 spot price was almost 32% below its 2011 average price, and ethane's price was nearly 48% below. Average spot prices for normal butane, isobutane, and natural gasoline fell during summer 2012 as oil prices fell, and returned to near the top of the five-year range toward the end of the year, although they were still below 2011 averages. Annual average spot prices for normal butane, isobutane, and natural gasoline were down relative to 2011 by 5%, 12%, and 7%, respectively.

Both production and stocks of ethane and propane were high, depressing prices and causing an increasing amount of ethane to be rejected. Ethane rejection is a phenomenon whereby ethane is left in the natural gas stream, so long as the heat content of the gas does not exceed the regulated limits. It occurs when the price of ethane is low relative to natural gas, or when the cost of removing ethane is high relative to its price. Propane has petrochemical applications, similar to ethane, but is also an important fuel for winter heating, especially in the Midwest and South. Because of elevated levels of wet natural gas production and the warm winter of 2011, propane stocks were high and prices were near multiyear lows by mid-year 2012.

Despite growing NGL production, other NGL products (normal butane, isobutane, and natural gasoline) have maintained higher price levels compared to ethane or propane. These NGL are primarily used as gasoline blendstock and to some degree compete with crude oil and crude derivatives. Accordingly, they are priced in relation to crude oil and tend to track it quite closely.