Electricity Monthly Update

End Use: December 2025

Retail rates/prices and consumption

In this section, we look at what electricity costs and how much is purchased. Charges for retail electric service are based primarily on rates approved by state regulators. However, a number of states have allowed retail marketers to compete to serve customers and these competitive retail suppliers offer electricity at a market-based price.

EIA does not directly collect retail electricity rates or prices. However, using data collected on retail sales revenues and volumes, we calculate average retail revenues per kWh as a proxy for retail rates and prices. Retail sales volumes are presented as a proxy for end-use electricity consumption.

Average revenue per kWh by state

Forty-four states and the District of Columbia saw increased revenue per kilowatt-hour (kWh) compared to last December, while average revenue per kWh increased by 7.1% on a national basis. The largest percent increase was in the District of Columbia, up 26.3%, followed by Pennsylvania, up 18.9%, and Rhode Island, up 16.3%. Average revenue per kWh figures decreased in five states compared to last year. The largest percent decrease was in Nevada, down 7.7%, followed by Connecticut, down 7.6%, and New Mexico, down 2.9%. In the contiguous US, California, Rhode Island, and Massachusetts had the highest average revenues at 28.18, 28.01, and 26.72 cents per kWh, respectively. North Dakota, New Mexico, and Iowa had the lowest average revenues at 8.12, 8.69, and 8.94 cents per kWh, respectively.

| Average Revenues/Sales (¢/kWh) | Retail Sales (thousand MWh) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| End-use sector | December 2025 | Change fromDecember 2024 | December 2025 | Change fromDecember 2024 | Year to Date | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Residential | 17.24 | 6.0% | 129,667 | 3.3% | 1,514,993 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial | 13.63 | 7.8% | 122,522 | 4.6% | 1,493,486 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Industrial | 8.53 | 7.2% | 84,907 | -0.0% | 1,042,217 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Transportation | 14.04 | 4.9% | 621 | 2.6% | 7,311 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | 13.73 | 7.1% | 337,716 | 2.9% | 4,058,007 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Source: U.S. Energy Information Administration | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total average revenues per kilowatt-hour (kWh) increased by 7.1% from last December, to 13.73 cents/kWh in December 2025. All four sectors saw increases in average revenues per kWh compared to last December. The Commercial sector saw the highest increase, up 7.8%, then the Industrial sector, up 7.2%, the Residential sector, up 6.0%, and finally the Transportation sector, up 4.9%. On a nationwide basis, retail sales increased by 2.9% in December 2025 compared to last December, with three sectors seeing increases. The Commercial sector saw the largest increase in retail sales from last December, up 4.6%, followed by the Residential sector, up 3.3%, and the Transportation sector, up 2.6%. The Industrial sector remained unchanged.

Retail sales

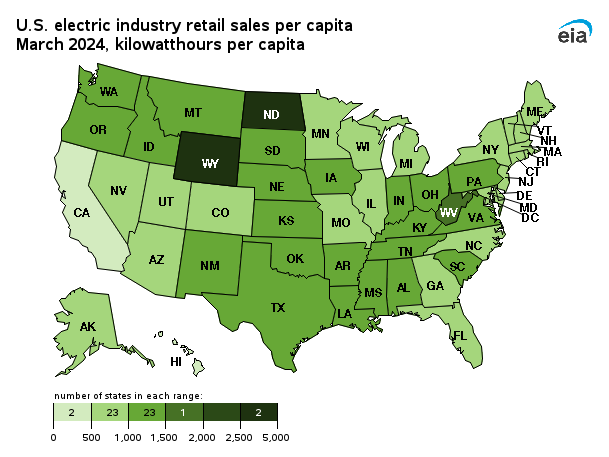

Forty-three states and the District of Columbia saw an increase in retail sales volume in December 2025 compared to last December. Rhode Island had the highest year over year percent increase in retail sales, up 15.6%, followed by Ohio, up 9.9%, and Nebraska, up 9.4%. Seven states saw a decrease in retail sales volume compared to last year. California had the highest year over year percent decrease, down 7.4%, followed by Idaho, down 3.6%, and Washington down 2.3%.

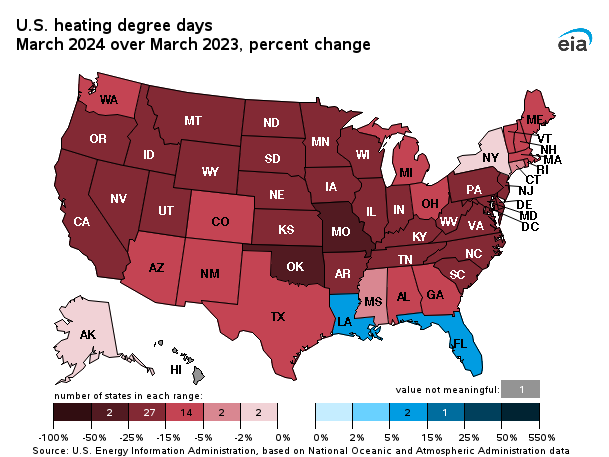

Thirty-five states and the District of Columbia saw an increase in HDDs compared to last December. Alaska had the highest year over year percent increase, up 33%, followed by the District of Columbia, up 20%, and Texas up 19%. Fourteen states saw a decrease in HDDs from last December. Florida had the highest percentage year over year decrease, down 17%, followed by Utah, down 16%, and Nevada, down 14%.