Electricity Monthly Update

Resource Use: December 2025

Supply and fuel consumption

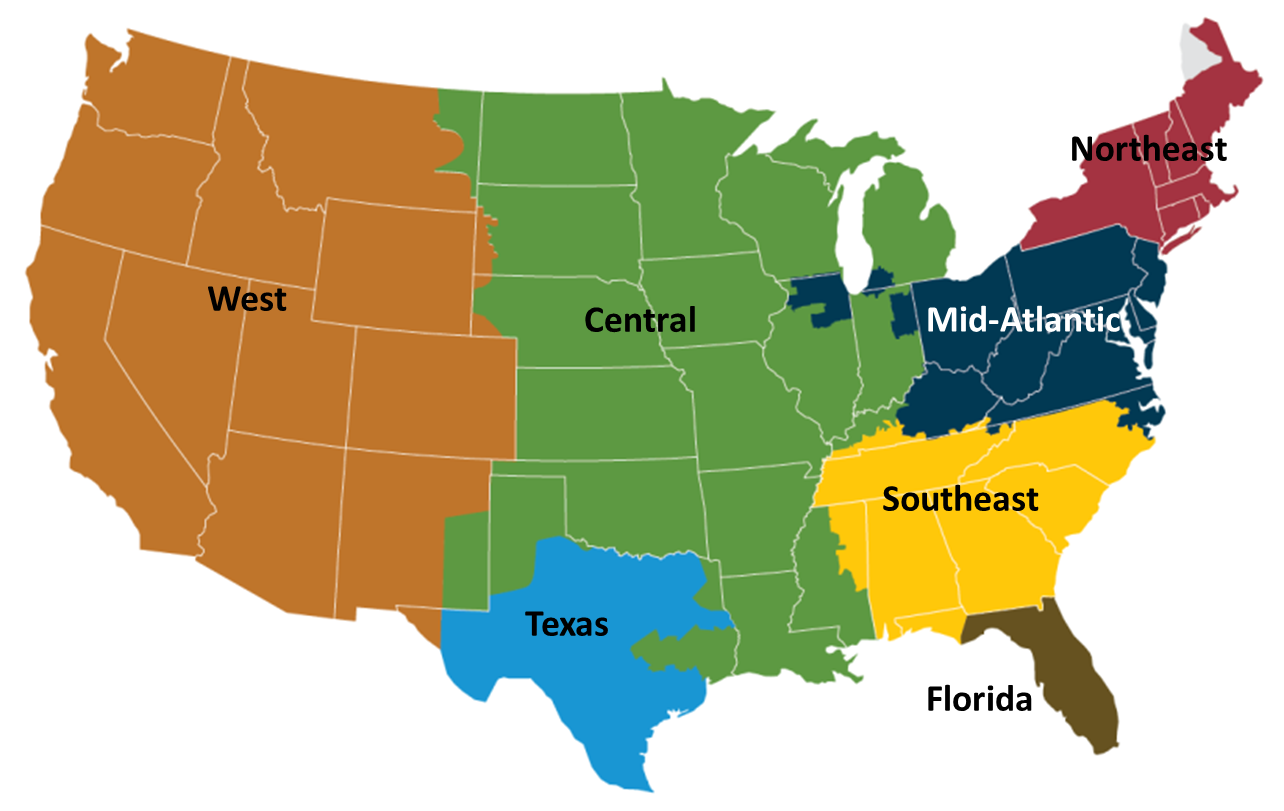

In this section, we look at the resources used to produce electricity. Generating units are chosen to run primarily on their operating costs, of which fuel costs account for the lion's share. Therefore, we present below, electricity generation output by fuel type and generator type. Since the generator/fuel mix of utilities varies significantly by region, we also present generation output by region.

Generation output by region

Net electricity generation in the United States increased 5.8% compared to December 2024. All areas of the country saw an increase in electricity generation compared to the previous December. The Northeast saw the largest year-over-year increase, up 9.6%, as this part of the country saw below average temperatures in December 2025 after experiencing slightly above average temperatures in December 2024. This led to a significant increase in residential heating this December compared to last year, which led to a significant increase in electricity demand.

The change in coal generation from the previous December was mixed throughout the country, with the MidAtlantic, Central, Southeast, and Florida all seeing a year-over-year increase in coal generation, while the Northeast, West, and Texas all saw a decrease in coal generation compared to December 2024. Most parts of the country, except for the Central and Western regions, saw an increase in natural gas generation compared to the previous year. Electricity generation from nuclear increased 1.9% compared to December 2024, while electricity generation from other renewables had a year-over-year increase in all regions, except the Southeast, when compared to the previous December.

Fossil fuel consumption by region

The chart above compares coal consumption in December 2024 and December 2025 by region and the second tab compares natural gas consumption by region over the same period. Changes in coal and natural gas consumption were similar to their respective changes in coal and natural gas generation.

The third tab presents the change in the relative share of fossil fuel consumption by fuel type on a percentage basis, calculated using equivalent energy content (Btu). This highlights changes in the relative market shares of coal, natural gas, and petroleum. The MidAtlantic, Central, Southeast, and Florida all saw their shares of coal increase at the expense of natural gas, while the West and Texas all saw their share of natural gas increase at the expense of coal. The Northeast saw other fossil fuels consumption increase at the expense of natural gas in December 2025. This occurred because the Northeast experienced below normal temperatures in December 2025 and the region has the propensity to dispatch oil-fueled generators when electricity demand gets high in the winter months.

The fourth tab presents the change in coal and natural gas consumption on an energy content basis by region. The changes in total coal and natural gas consumption were similar to the changes seen in total coal and natural gas net generation in each region.

Fossil fuel prices

November 2025 and December 2025 average fossil fuel spot prices were not available when the February 2026 Electricity Monthly Update was published.