Electricity Monthly Update

Regional Wholesale Markets: November 2025

The United States has many regional wholesale electricity markets. Below we look at monthly and annual ranges of on-peak, daily wholesale prices at selected pricing locations and daily peak demand for selected electricity systems in the Nation. The range of daily prices and demand data is shown for the report month and for the year ending with the report month.

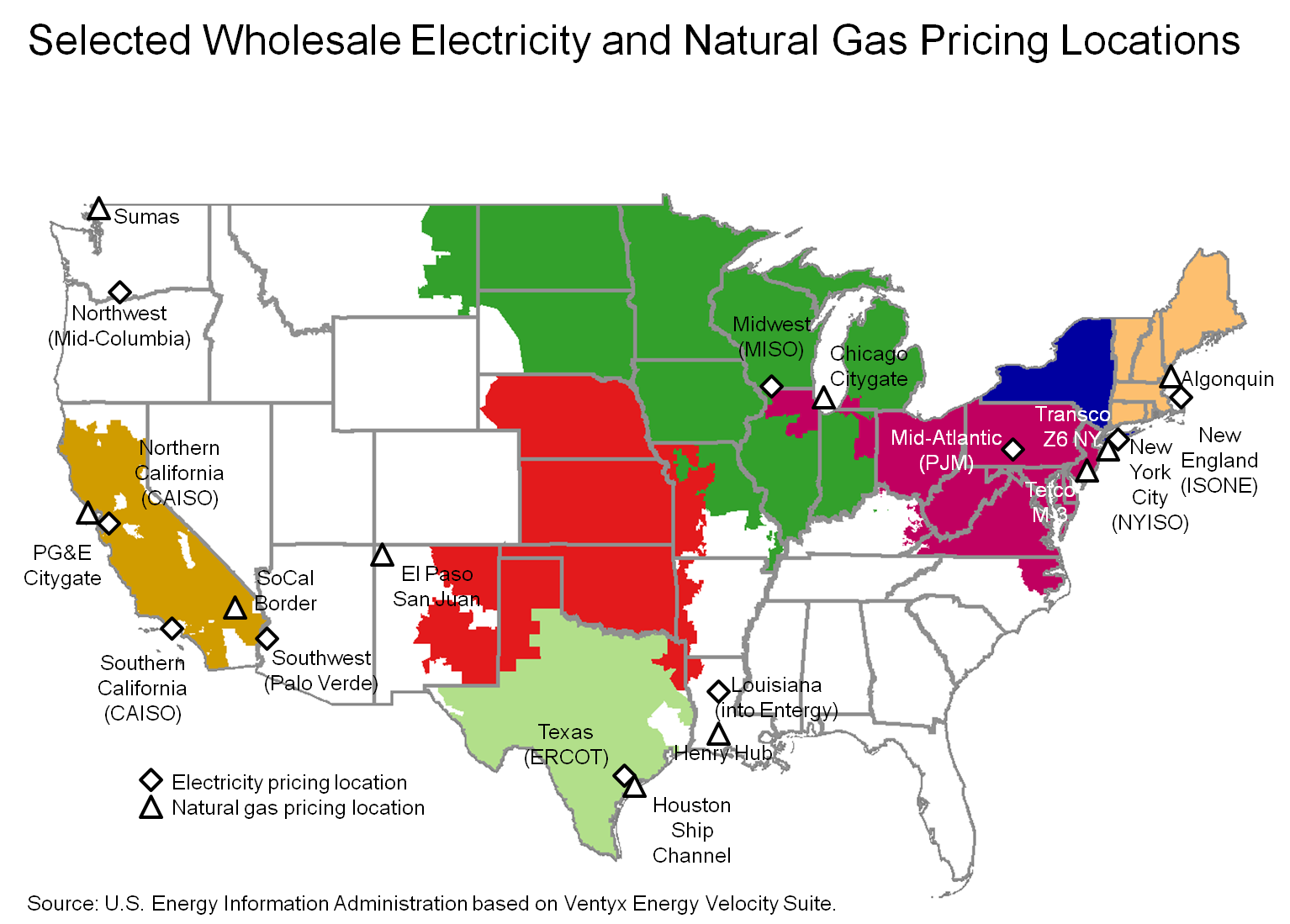

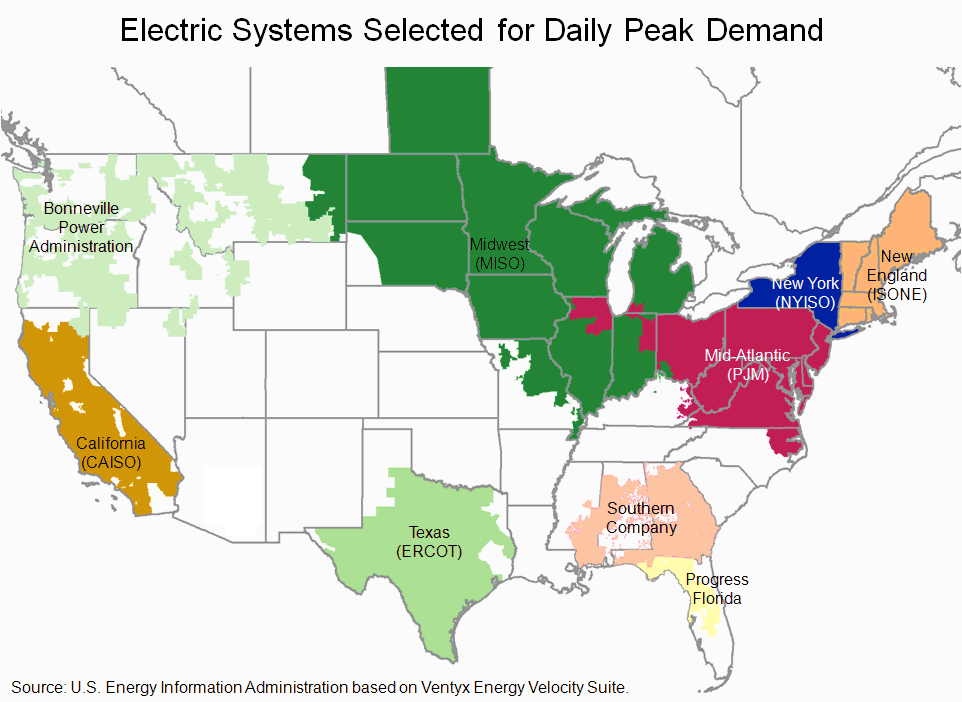

Prices and demand are shown for six Regional Transmission Operator (RTO) markets: ISO New England (ISO-NE), New York ISO (NYISO), PJM Interconnection (PJM), Midwest ISO (MISO), Electric Reliability Council of Texas (ERCOT), and two locations in the California ISO (CAISO). Also shown are wholesale prices at trading hubs in Louisiana (into Entergy), Southwest (Palo Verde) and Northwest (Mid-Columbia). In addition to the RTO systems, peak demand is also shown for the Southern Company, Progress Florida, and the Bonneville Power Authority (BPA). Refer to the map tabs for the locations of the electricity and natural gas pricing hubs and the electric systems for which peak demand ranges are shown.

In the second tab immediately below, we show monthly and annual ranges of on-peak, daily wholesale natural gas prices at selected pricing locations in the United States. The range of daily natural gas prices is shown for the same month and year as the electricity price range chart. Wholesale electricity prices are closely tied to wholesale natural gas prices in all but the center of the country. Therefore, one can often explain current wholesale electricity prices by looking at what is happening with natural gas prices.

Wholesale prices

Electricity system daily peak demand

In November 2025, all electricity systems across the country experienced daily peak electricity demand at or near their lowest levels for the annual range ending November 2025. Progress Florida, in particular, saw peak electricity demand very close to the lowest that the region has observed over the preceding twelve month period.