Forecast overview

- Winter Fuels Outlook. This month we published the Winter Fuels Outlook that details our expectations for energy expenditures this winter. In general, we expect relatively little change in energy bills for much of the country this winter from last winter as lower energy prices mostly offset colder weather.

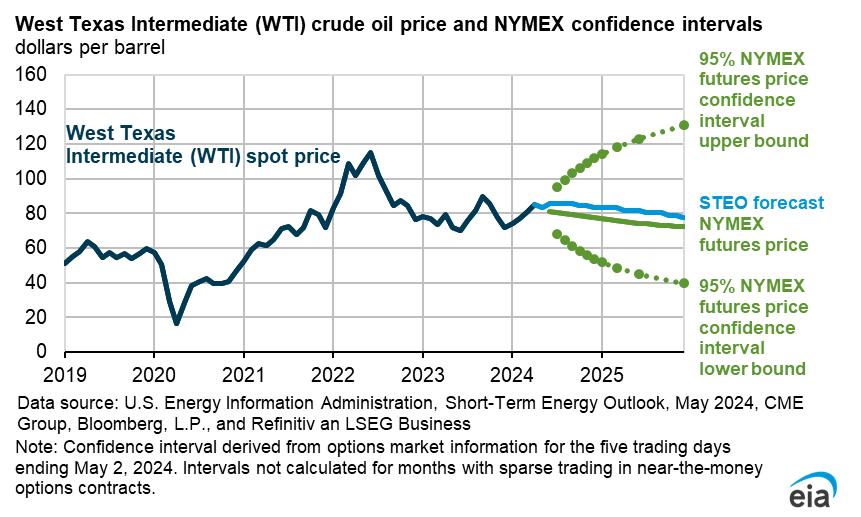

- Crude oil prices. We reduced our forecast for the Brent crude oil spot price through the end of next year. In this month’s outlook, we expect the Brent price will average $78 per barrel (b) in 2025, $7/b less than we expected in last month’s STEO. In our forecast, lower crude oil prices largely reflect a reduction for global oil demand growth in 2025. Although we reduced our crude oil price forecast, crude oil prices have risen in recent days because of escalating conflict in the Middle East, raising the possibility of oil supply disruptions and further crude oil price increases.

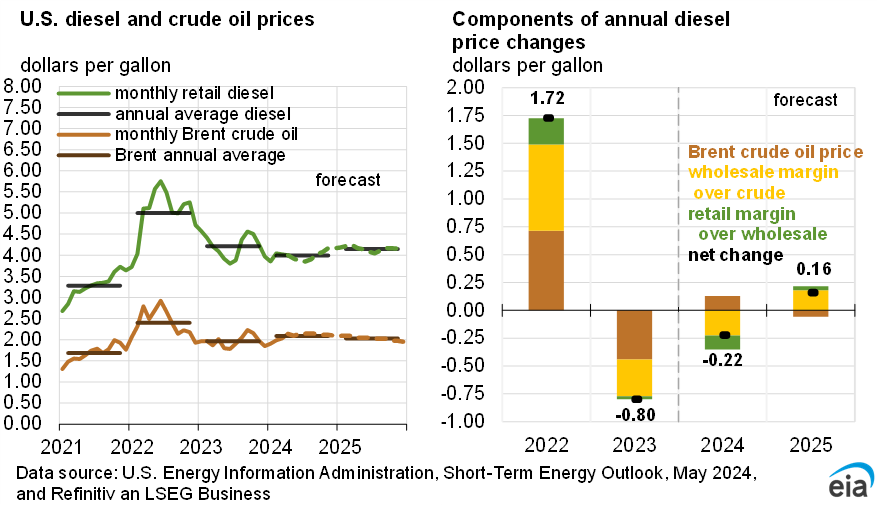

- Petroleum product price. Lower crude oil prices reduce our forecast prices for most petroleum products. The largest change from our last forecast is for propane. We forecast the Mont Belvieu propane spot price will average 72 cents per gallon (gal) in 2025, down 15% from our forecast of 84 cents/gal last month. For other products, we now expect the retail diesel price will average about $3.50/gal next year, down by 5% from last month’s forecast. We expect the U.S. average retail gasoline price will average $3.20/gal next year, down 2% from last month.

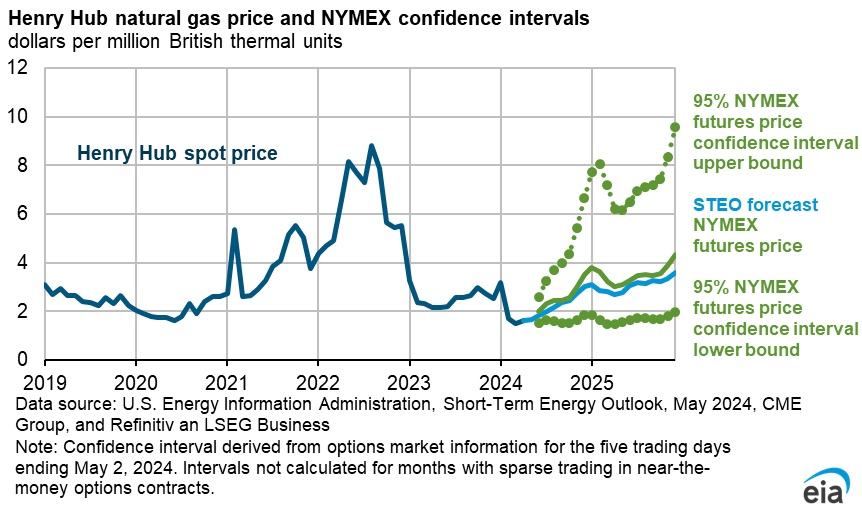

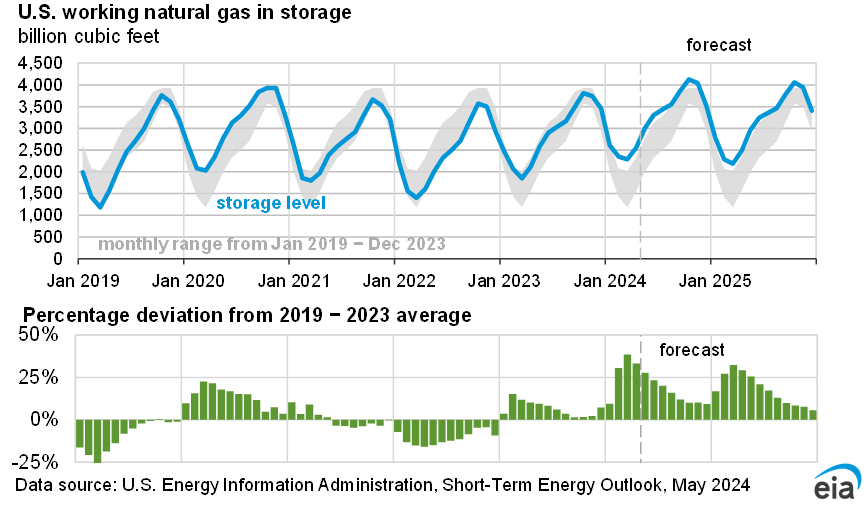

- Natural gas prices. The Henry Hub natural gas spot price rose by 15% to $2.28 per million British thermal units (MMBtu) in September. We expect the Henry Hub price to continue rising to around $2.80/MMBtu in the fourth quarter of 2024 and to further increase to around $3.10/MMBtu on average in 2025 as liquefied natural gas exports, a component of total natural gas demand, increase with the addition of capacity.

- Electricity consumption. Hot summer temperatures increased U.S. electricity demand across all sectors in 2024. We expect residential electricity sales to increase by 3% in 2024 and by another 1% in 2025. Similarly, electricity demand in the commercial and industrial sectors is expected to grow, increasing by a combined 2% in both 2024 and 2025.

| Notable Forecast Changes | 2024 | 2025 |

|---|---|---|

Note: Values in this table are rounded and may not match values in other tables in this report. |

||

| Brent crude oil spot price (dollars per barrel) | $81 | $78 |

| Previous forecast | $83 | $84 |

| Percentage change | -2.3% | -7.7% |

| Wholesale diesel price (dollars per gallon) | $2.40 | $2.30 |

| Previous forecast | $2.50 | $2.50 |

| Percentage change | -3.0% | -8.4% |

| Mt. Belvieu propane spot price (dollars per gallon) | $0.80 | $0.70 |

| Previous forecast | $0.80 | $0.80 |

| Percentage change | -4.8% | -14.7% |

You can find more information in the detailed table of forecast changes.