Global oil markets

Global oil prices and inventories

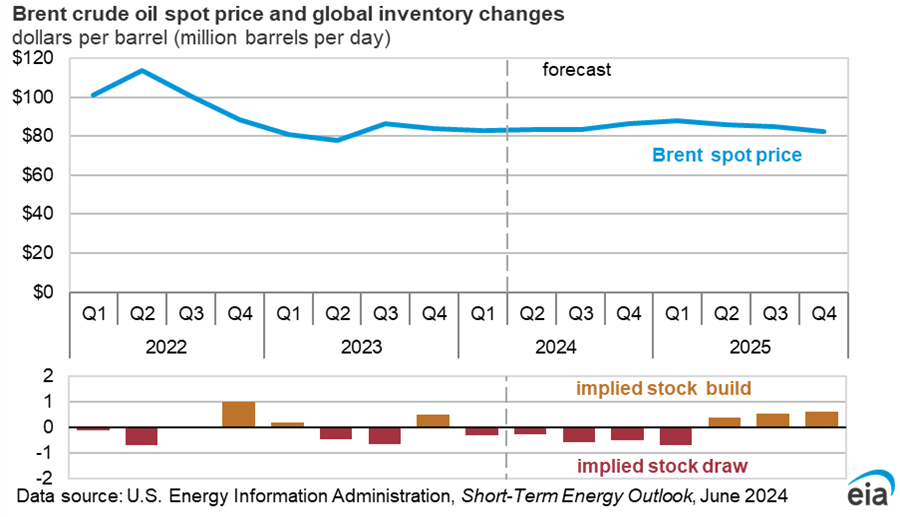

The Brent crude oil spot price averaged $82 per barrel (b) in May, down $8/b from April. Daily spot prices also initially fell following the OPEC+ announcement on June 2, closing at $78/b on June 6. The extension of OPEC+ cuts through 3Q24 led us to reduce our forecast for OPEC+ oil production for the rest of 2024. We expect less OPEC+ production for the rest of this year will cause Brent prices to rise to an average of $85/b during the second half of 2024 (2H24). Because of less OPEC+ production, we expect more oil will be withdrawn from global inventories in 2H24 than we did last month. Despite more inventory draws in this month’s forecast, we lowered our expectation for the annual average Brent price in 2024 compared with the May STEO to reflect the lower starting point for the forecast resulting from the recent price decline.

In our May outlook, we had assumed OPEC+ would begin to relax some voluntary production cuts beginning in 3Q24. We now expect OPEC+ will not begin relaxing voluntary cuts until 4Q24, in line with the group’s recent announcement. Although crude oil prices initially fell following the OPEC+ announcement, we expect the extension of all voluntary cuts through 3Q24 will cause global oil inventories to continue falling through 1Q25 and put upward pressure on oil prices over that period.

Global oil inventories fell by an estimated 0.3 million barrels per day (b/d) in the first half of 2024 (1H24), and we expect they will decrease by an average of 0.6 million b/d from 3Q24 through 1Q25. Following the start of the phaseout of voluntary OPEC+ supply cuts in 4Q24 and supported by the ongoing supply growth from countries outside of OPEC+, we expect growth in global oil supply will outweigh growth in global oil demand growth, returning the market to moderate inventory builds for most of 2025. We forecast that global oil inventories will begin increasing at an average of 0.4 million b/d in 2Q25 and will increase by 0.6 million b/d in the second half of 2025.

As a result, we expect oil prices will increase to an average of $87/b in 4Q24 and $88/b in 1Q25. As global oil inventories rise during most of 2025, we forecast the Brent crude oil price will gradually fall to an average of $83/b by 4Q25.

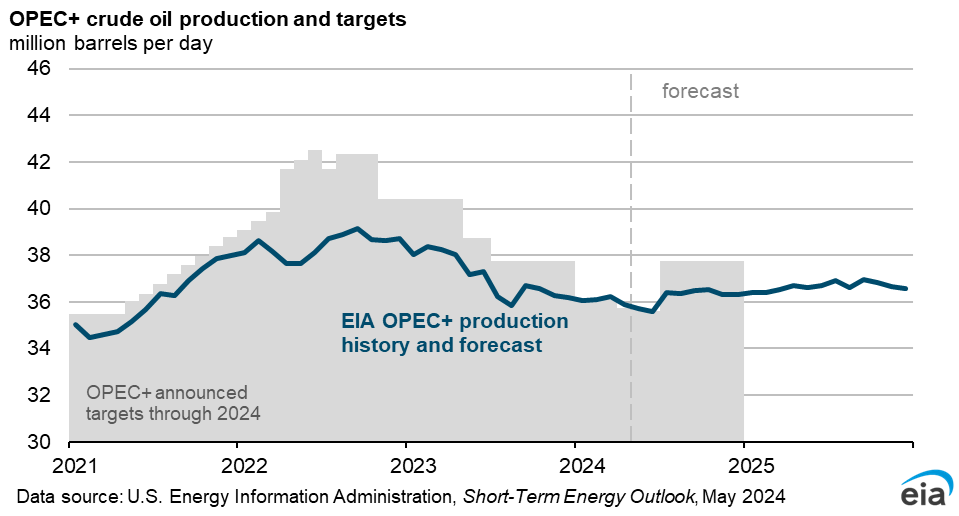

Global oil production We expect OPEC+ will largely adhere to production targets announced on June 2. The announcement extends the additional voluntary production cuts by countries such as Saudi Arabia and Russia, which were set to expire at the end of June 2024, through September 2024. Beginning in October, these member countries plan to gradually phase out their production cuts on a monthly basis through the end of September 2025. In addition, the round of production cuts that OPEC+ participants announced in April 2023 and were set to expire at the end of 2024 were also extended through the end of 2025. Given the extension of these production cuts, our expectation is that OPEC+ crude oil production will follow these new targets until early 2025. At that time, we expect that some OPEC+ producers will keep production below the targets in an effort to limit global oil inventory builds.

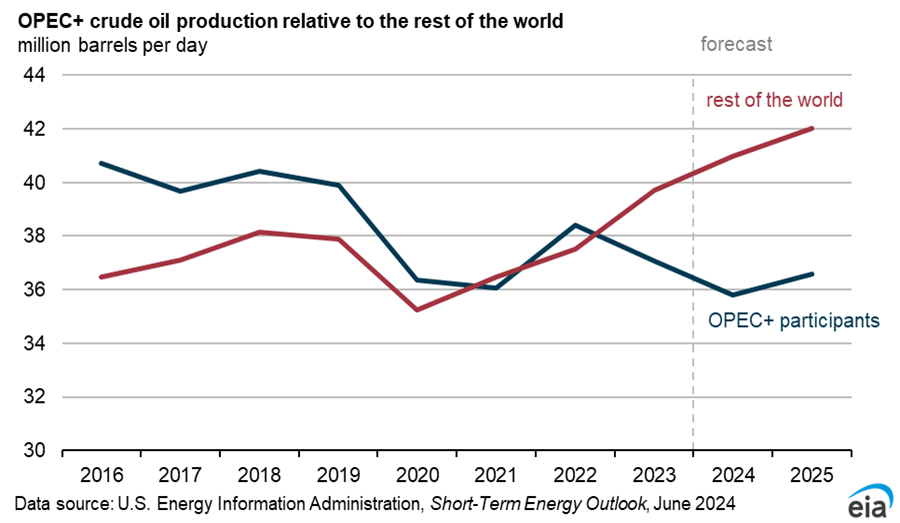

Although OPEC+ cuts are limiting growth in world oil production, we estimate that production growth outside of OPEC+ will remain strong. Forecast production outside of OPEC+ increases by almost 2.0 million b/d in 2024, led by increasing production from the United States, Canada, Brazil, and increasingly Guyana. We expect that global production of petroleum and other liquid fuels will increase by 0.8 million b/d in 2024, which is 0.2 million b/d less than in last month’s STEO because of the extension of voluntary OPEC+ production cuts through 3Q24. We now expect OPEC+ liquid fuels production to decrease by 1.2 million b/d in 2024.

In 2025, we expect that global production of liquid fuels will increase by 2.2 million b/d. As the gradual phaseout of the first round of OPEC+ voluntary production cuts unfolds throughout the year, OPEC+ production increases by 0.7 million b/d combined with 1.4 million b/d of production growth from countries outside of OPEC+.

Global oil consumption

We forecast that global consumption of liquid fuels will increase by 1.1 million b/d in 2024 and 1.5 million b/d in 2025. Most of the expected growth is from non-OECD countries, which increase their liquid fuels consumption by 1.1 million b/d in 2024 and 1.3 million b/d in 2025. The growth in non-OECD consumption is led by China and India, which we expect will increase consumption by a combined 0.6 million b/d in 2024 and 0.7 million b/d in 2025. In addition, we expect an increase in liquid fuels consumption from non-OECD Asia because of increased bunker fuel demand driven by Red Sea disruptions and longer shipping routes for tankers. We expect increases related to bunker fuels will contribute around 10% of total oil consumption growth in 2024. In OECD countries, liquid fuels consumption stays relatively flat in 2024 and increases by 0.3 million b/d in 2025.