Forecast overview

- Global oil consumption. India has emerged as the leading source of growth in global oil consumption in our forecast. Over 2024 and 2025, India accounts for 25% of total oil consumption growth globally. We expect an increase of 1.0 million barrels per day (b/d) in global consumption of liquid fuels in 2024. We expect even more growth next year, with global oil consumption rising by 1.2 million b/d.

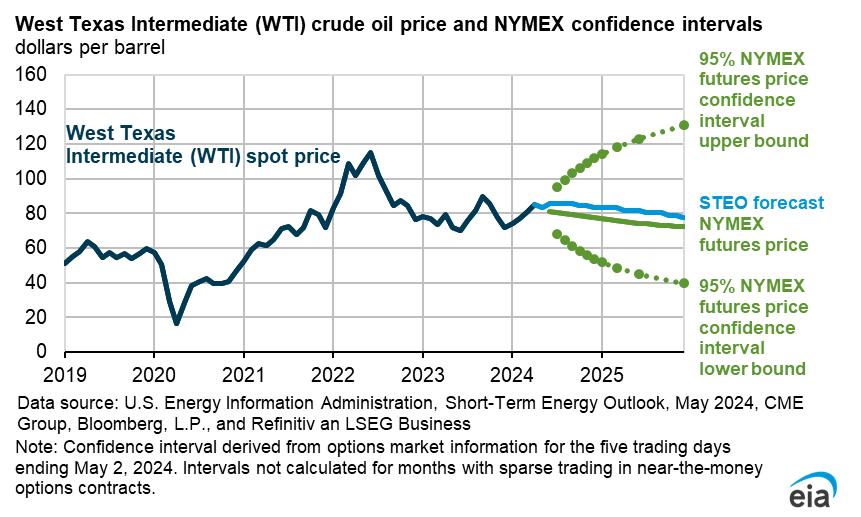

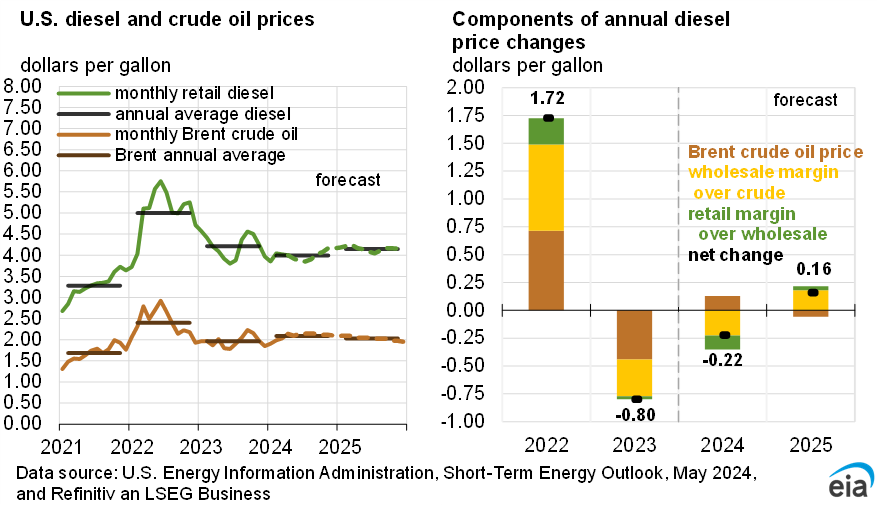

- Global oil inventories and prices. We expect that ongoing geopolitical risks and withdrawals from global oil inventories stemming from OPEC+ production cuts will place upward pressure on oil prices over the next few months, with the Brent crude oil price averaging $78 per barrel (b) in the first quarter of 2025 (1Q25). However, we forecast that global oil production growth means inventories will begin building in 2Q25, reducing crude oil prices through the end of the year. We expect the Brent price will fall to an average of $74/b in the second half of 2025.

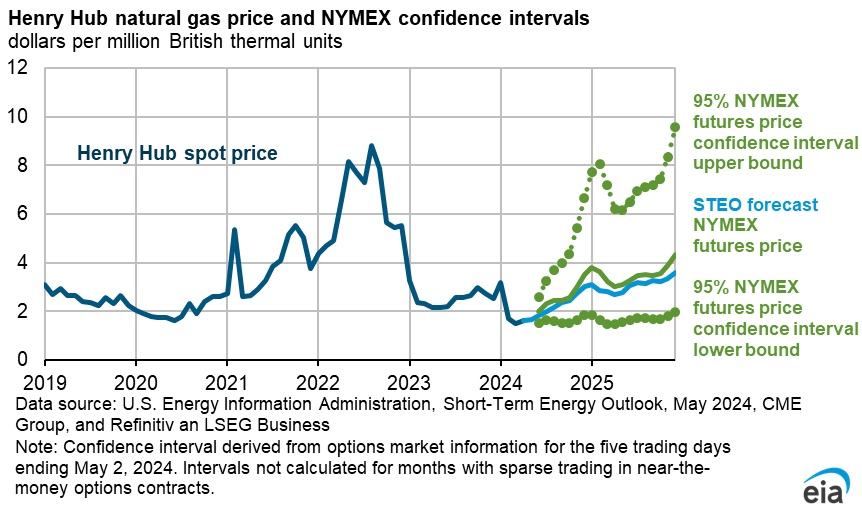

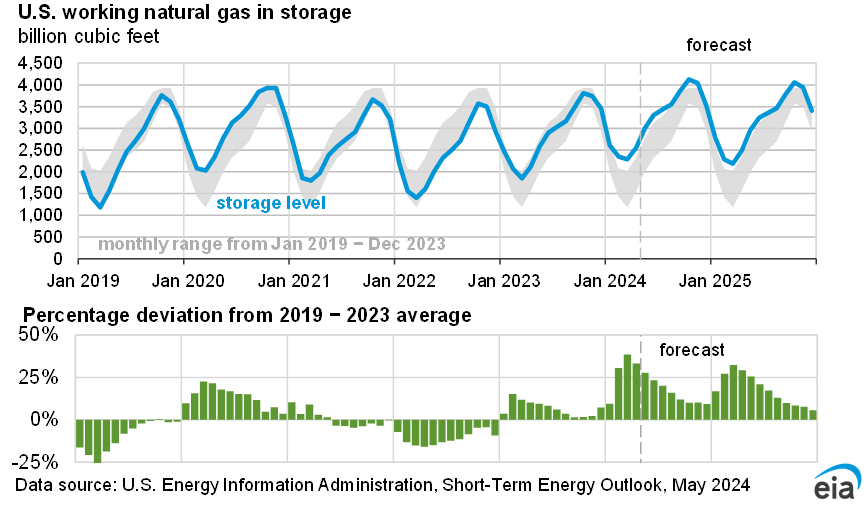

- Natural gas prices. We expect the Henry Hub natural gas spot price to rise in the coming months to average $2.80 per million British thermal units (MMBtu) in 1Q25, following seasonal patterns during which prices typically rise during the winter. The monthly average Henry Hub daily spot price fell to $2.20/MMBtu in October and below $2.00/MMBtu in early November. Low prices reflected warm temperatures, which could delay the beginning of withdrawals of natural gas from storage until mid-November. We expect the Henry Hub price to average around $2.90/MMBtu in 2025, as global demand for U.S. liquefied natural gas exports, a component of U.S. natural gas demand, continues to increase.

- Natural gas production. Marketed U.S. natural gas production in our forecast averages 113 billion cubic feet per day (Bcf/d) in 2024. Production in 2024 is relatively unchanged from 2023, a contrast to the production growth in the previous three years, as low natural gas prices curtailed production in some regions. We expect U.S. marketed natural gas production to increase by 1% next year, averaging 114 Bcf/d, led by a 6% increase in the Permian region.

- Electricity generation. We expect U.S. electric power sector generation to increase by 3% in 2024. The increase in generation is mostly to supply increased air-conditioning demand compared with last year, driven by hotter summer temperatures this year. The increase in consumption in 2024 is being supplied primarily from growth in use of natural gas (up 3% from 2023) and solar power (up 34%). We forecast that U.S. solar generation will continue growing by another 31% in 2025 as solar generating capacity expands, while higher natural gas prices reduce electricity demand from the natural gas sector.

| Notable Forecast Changes | 2024 | 2025 |

|---|---|---|

Note: Values in this table are rounded and may not match values in other tables in this report. Percentages are calculated from unrounded values. |

||

| Mont. Belvieu propane spot price (dollars per gallon) | $0.80 | $0.80 |

| Previous forecast | $0.80 | $0.70 |

| Percentage change | 3.4% | 13.4% |

| Henry Hub spot price (dollars per million British thermal units) | $2.20 | $2.90 |

| Previous forecast | $2.30 | $3.10 |

| Percentage change | -4.8% | -5.2% |

You can find more information in the detailed table of forecast changes.