Forecast overview

- Global oil production. Growth in oil production next year will come mostly from non-OPEC countries because of ongoing production restraint on the part of OPEC+. At its December 5 meeting, OPEC+ announced that it would delay production increases until April 2025. Those increases had been set to begin in January 2025. We forecast that global oil production will increase by 1.6 million barrels per day (b/d) in 2025, and we expect almost 90% of that growth will come from countries that do not participate in OPEC+.

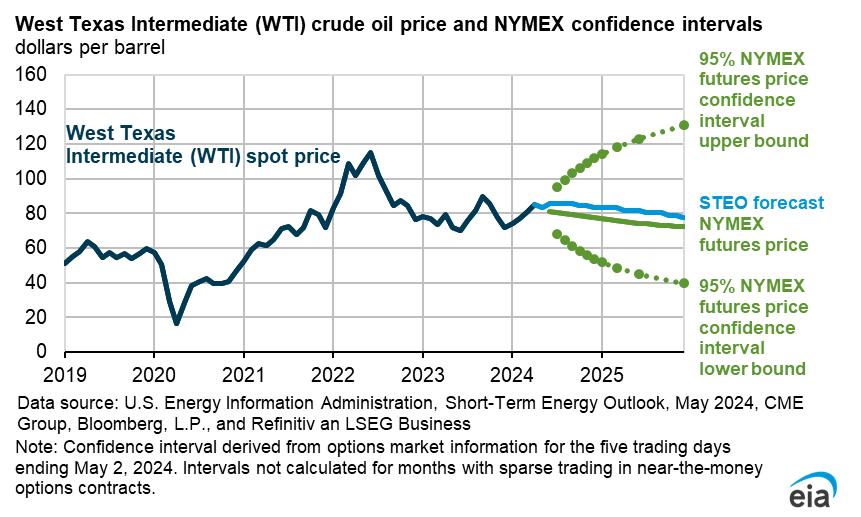

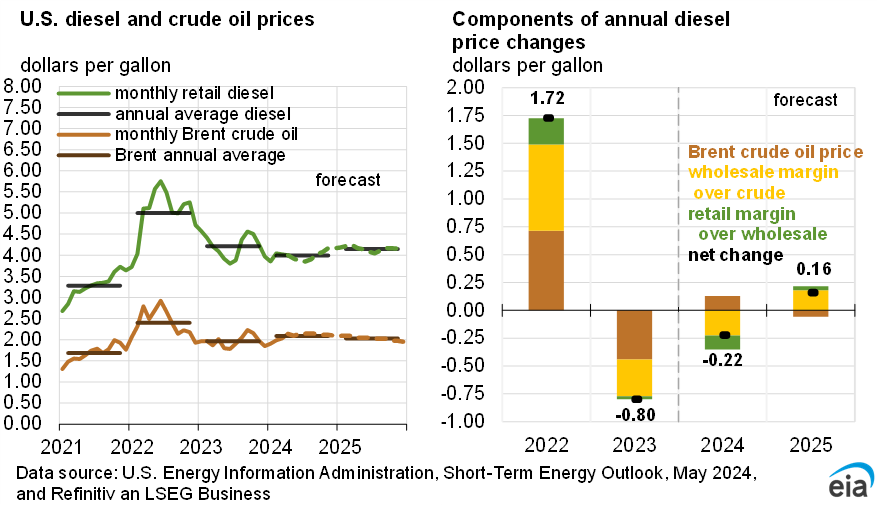

- Global oil prices. We expect the Brent crude oil spot price will remain close to its current level in 2025, averaging $74 per barrel for the year, as oil markets will be relatively balanced on an annual average basis.

- U.S. crude oil net imports. Net imports of crude oil in the United States this year have remained close to 2023 volumes with increasing U.S. crude oil production supplying an almost equivalent increase in U.S. refinery runs. We expect U.S. crude oil production will continue increasing in 2025 even as U.S. refiners process less crude oil than they did this year, leading to net imports of crude oil falling by more than 20% to 1.9 million barrels per day (b/d) in 2025, which would be the least net imports of crude oil in any year since 1971.

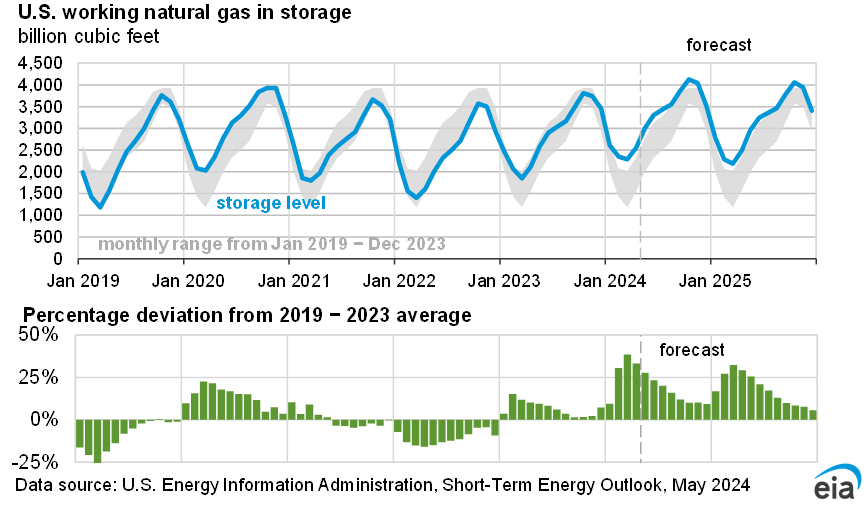

- Natural gas storage. Natural gas inventories in our forecast remain above the five-year average (2019–2023) throughout the winter heating season (November—March) after ending the injection season 6% above the five-year average in mid-November. We expect natural gas inventories to total 1,920 billion cubic feet (Bcf) at the end of March 2025, which would be 2% more than the five-year average.

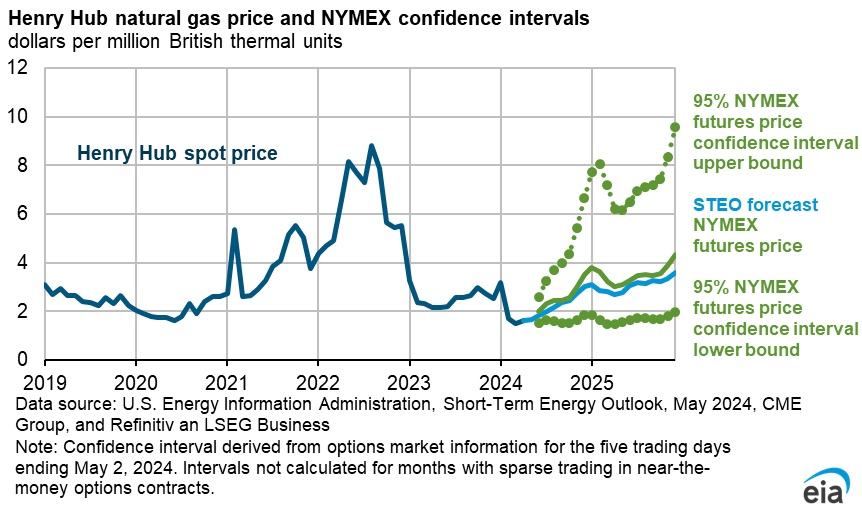

- Natural gas prices. Based on our expectation that the storage surplus to the five-year average will narrow over the winter, we forecast the U.S. benchmark Henry Hub spot price will increase from an average of just over $2.00 per million British thermal units (MMBtu) in November to an average of about $3.00/MMBtu for the rest of the winter heating season.

- Electricity consumption. We expect U.S. sales of 2% more electricity this winter compared with last winter. The increase is led by 3% more sales to residential customers because of colder weather than last winter. Although the winter heating season got off to a warm start in November, overall we expect this winter to be colder than last year, with 6% more heating degree days.

| Notable Forecast Changes | 2024 | 2025 |

|---|---|---|

Note: Values in this table are rounded and may not match values in other tables in this report. Percentages are calculated from unrounded values. |

||

| U.S.natural gas end-of-year inventories (billion cubic feet) | 3,371 | 3,160 |

| Previous forecast | 3,409 | 3,236 |

| Percentage change | -1.1% | -2.3% |

You can find more information in the detailed table of forecast changes.